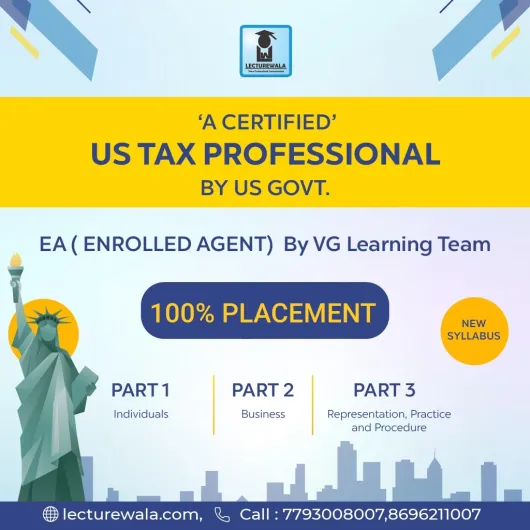

About EA

An Enrolled Agent (EA) is a federally authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the US Department of the Treasury to represent taxpayers before the IRS (Internal Revenue Service).As an enrolled agent you will be able to prepare tax returns, represent clients before IRS, have unlimited representation rights, appeal for clients in front of IRS and advise clients on tax implications based on their business transactions.