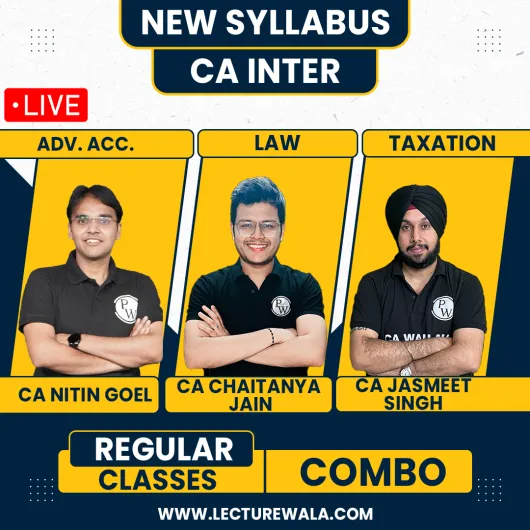

CA Inter Pro Udesh Regular May 2026 Group 1 Combo by Pw : Online Classes

| FACULTY NAME | Nitin Goel Sir Chaitanya Jain Sir Jasmeet Singh Sir |

|---|---|

| BRAND NAME | CA WALLAH |

| COURSE | CA Inter |

| COURSE NAME | Advanced Accounting By Nitin Goel Sir Corporate and Other Law By Chaitanya Jain Sir Taxation By Jasmeet Singh Sir Taxation ( GST ) By Jasmeet Singh Sir |

| SYLLABUS | New Syllabus |

| NO. OF LECTURES | Adv. Accounting :- Download Law:- Download Taxation :- Download Taxation ( GST ) :- Download |

| Duration | 16 July 2025 - 31 December 2025 |

| BATCH FEATURES | LIVE and RECORDED Classes 24x7 Doubt support Class Notes and Practice Sheets Mentorship E books Hard Copy of Books Khazana Subjective tests & Analysis Access to upcoming batches of CA Inter May 2026 Batches |

| VIDEO LANGUAGE | Hinglish |

| ATTEMPT | May 2026 |

| MODE | Google Drive |

| STUDY MATERIAL | E-books / |

| STUDY MATERIAL LANGUAGE | English |

| NO. OF VIEWS | Unlimited views |

| VALIDITY | 31st May 2026 |

| FAST FORWARD | Yes |

| CLASSES RUN | Videos runs on Android Phone, Windows Laptop, iOS, Android Tab, Mac Book |

| SYSTEM REQUIREMENT | "Mobile App- Any version above 6 Windows: any above 7 with 64 BIT" |

| How the Doubt clearing session will be available? | 24*7 Doubt Engine |

| More Details | 01.Lectures will be the combination of recorded + live classes with unlimited views. 02.Doubt solving platform will be provided. 03.The syllabus will be completed by Dec 2025. 04.Syllabus will be covered as per the new scheme. 05.Class Notes and Practice Sheets will be provided. 06.Every Sunday a Practice Test will be provided for 2 subjects. 07.Free E-Books for CA Inter Group 1 subjects will be provided. 08.5 Subjective tests per subject with analysis will be provided. 09.The registration fee is included in the price of the batch which is showing on the website. The breakup of registration fee will be mentioned on invoice. You may be provided with access to Notes, PYQ’s. Mock Test Papers, AITS Test Series, Previous year batches & other materials, the access can vary depending on the batch you purchase, so that exact details might change from one batch to another. |

| Frequently Asked Questions :- | 1). Who should join this batch? > Students who are targeting group 1 in CA Intermediate May 2026 Exam 2). Will classes be live or recorded? Lectures will be the combination of recorded + live classes with unlimited views. 3). Till when can I access the batch? You can access the batch till 31st May 2026. 4).Can I get a refund after the batch purchase? Dear student, refund after batch purchase is not allowed as we have already invested a lot in providing the best learning experience to our loving students in terms of tech infrastructure, employee salary etc. Please make a conscious decision before purchasing the batch. |

| About This Batch | 1). Course Duration : -Starts on 16 Jul 2025 Ends on 31 May 2026 2). Validity: - 31st May 2026 3). Online lectures 4). DPPs and Tests With Solutions 5). Counselling and guidance at PW CA offline centres 6).Subjects: Advanced Accounting , Corporate and Other Laws , Taxation , Taxation (GST) |

- Availability: 100

Rs. 12,999

Rs. 21,000 38% off| FACULTY NAME | Nitin Goel Sir Chaitanya Jain Sir Jasmeet Singh Sir |

|---|---|

| BRAND NAME | CA WALLAH |

| COURSE | CA Inter |

| COURSE NAME | Advanced Accounting By Nitin Goel Sir Corporate and Other Law By Chaitanya Jain Sir Taxation By Jasmeet Singh Sir Taxation ( GST ) By Jasmeet Singh Sir |

| SYLLABUS | New Syllabus |

| NO. OF LECTURES | Adv. Accounting :- Download Law:- Download Taxation :- Download Taxation ( GST ) :- Download |

| Duration | 16 July 2025 - 31 December 2025 |

| BATCH FEATURES | LIVE and RECORDED Classes 24x7 Doubt support Class Notes and Practice Sheets Mentorship E books Hard Copy of Books Khazana Subjective tests & Analysis Access to upcoming batches of CA Inter May 2026 Batches |

| VIDEO LANGUAGE | Hinglish |

| ATTEMPT | May 2026 |

| MODE | Google Drive |

| STUDY MATERIAL | E-books / |

| STUDY MATERIAL LANGUAGE | English |

| NO. OF VIEWS | Unlimited views |

| VALIDITY | 31st May 2026 |

| FAST FORWARD | Yes |

| CLASSES RUN | Videos runs on Android Phone, Windows Laptop, iOS, Android Tab, Mac Book |

| SYSTEM REQUIREMENT | "Mobile App- Any version above 6 Windows: any above 7 with 64 BIT" |

| How the Doubt clearing session will be available? | 24*7 Doubt Engine |

| More Details | 01.Lectures will be the combination of recorded + live classes with unlimited views. 02.Doubt solving platform will be provided. 03.The syllabus will be completed by Dec 2025. 04.Syllabus will be covered as per the new scheme. 05.Class Notes and Practice Sheets will be provided. 06.Every Sunday a Practice Test will be provided for 2 subjects. 07.Free E-Books for CA Inter Group 1 subjects will be provided. 08.5 Subjective tests per subject with analysis will be provided. 09.The registration fee is included in the price of the batch which is showing on the website. The breakup of registration fee will be mentioned on invoice. You may be provided with access to Notes, PYQ’s. Mock Test Papers, AITS Test Series, Previous year batches & other materials, the access can vary depending on the batch you purchase, so that exact details might change from one batch to another. |

| Frequently Asked Questions :- | 1). Who should join this batch? > Students who are targeting group 1 in CA Intermediate May 2026 Exam 2). Will classes be live or recorded? Lectures will be the combination of recorded + live classes with unlimited views. 3). Till when can I access the batch? You can access the batch till 31st May 2026. 4).Can I get a refund after the batch purchase? Dear student, refund after batch purchase is not allowed as we have already invested a lot in providing the best learning experience to our loving students in terms of tech infrastructure, employee salary etc. Please make a conscious decision before purchasing the batch. |

| About This Batch | 1). Course Duration : -Starts on 16 Jul 2025 Ends on 31 May 2026 2). Validity: - 31st May 2026 3). Online lectures 4). DPPs and Tests With Solutions 5). Counselling and guidance at PW CA offline centres 6).Subjects: Advanced Accounting , Corporate and Other Laws , Taxation , Taxation (GST) |